Can You Collect Cpp And Live In Another Country

Your oas benefits and cppqpp pension can be received as a direct deposit to your local bank account and in the local currency. Includes information on employment insurance ei pensions benefits and taxes for those who work or live outside of canada.

What Happens To Oas And Cpp Pension If You Retire Abroad

What Happens To Oas And Cpp Pension If You Retire Abroad

can you collect cpp and live in another country

can you collect cpp and live in another country is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you collect cpp and live in another country content depends on the source site. We hope you do not use it for commercial purposes.

Spending time outside canada may change the way you receive your oas and cpp payments.

Can you collect cpp and live in another country. Benefits for canadians living abroad. Yes when you are before retiring time canada is good but with the taxes that are growing each year i started to think about retiring in another country in europe. You can receive your payments directly into your local bank account if you live in a country that offers the service of direct deposit.

Receiving your old age security oas and canada pension plan cpp payments in the local currency can save you money. The canada pension plan cpp is a monthly payment made to people who contributed to the cpp during their working years. If you receive cppqpp or oas while living in the us brian there will be no income tax withholding at source as a result of provisions in the canada united states convention with respect to.

You can get a list of the countries where this is available from the government of canada website. Because your payments will have already been converted into the local currency of the country where you live you should get a. Some canadian banks have partner branches in other countries around the world which can save you plenty of money on fees if you work with the two banks.

If you did not live in canada for long enough to get a full pension or you moved to canada from another country you may also qualify to combine your pensions from both countries. It is possible to have your cpp or oas pension direct deposited into your bank account in your new country of residence in the local currency. Public pension benefits when living outside canada old age security oas is a monthly payment available to canadians over the age of 65.

To help you qualify for a canadian pension or benefit. Canada has many international social security agreements with other. If you dont or cant choose to have the money directly deposited there are other ways to move your cpp and oas overseas from a canadian bank account.

How to receive your oas and cpp payments abroad. Or moving in another country with the canadian retirement plan you can live decently. Your periods of contribution under the legislation of another country may be considered as periods of contribution to the canada pension plan cpp.

A social security agreement may help you qualify for a canadian or foreign benefit or both if you lived or worked abroad and in canada. You are also eligible to receive the cpp survivors pension and childrens benefit even if you live outside canada. If the receiver general of canada service canada is unable to issue direct payments because of restrictions where you reside a cheque is made out in canadian dollars and sent to you via mail.

Receiving payment of old age security and canada pension plan pensions and benefits outside canada. If not banks tend to.

What Happens To Oas And Cpp Pension If You Retire Abroad

What Happens To Oas And Cpp Pension If You Retire Abroad

Have You Considered A Permanent Retirement Overseas Read This

Have You Considered A Permanent Retirement Overseas Read This

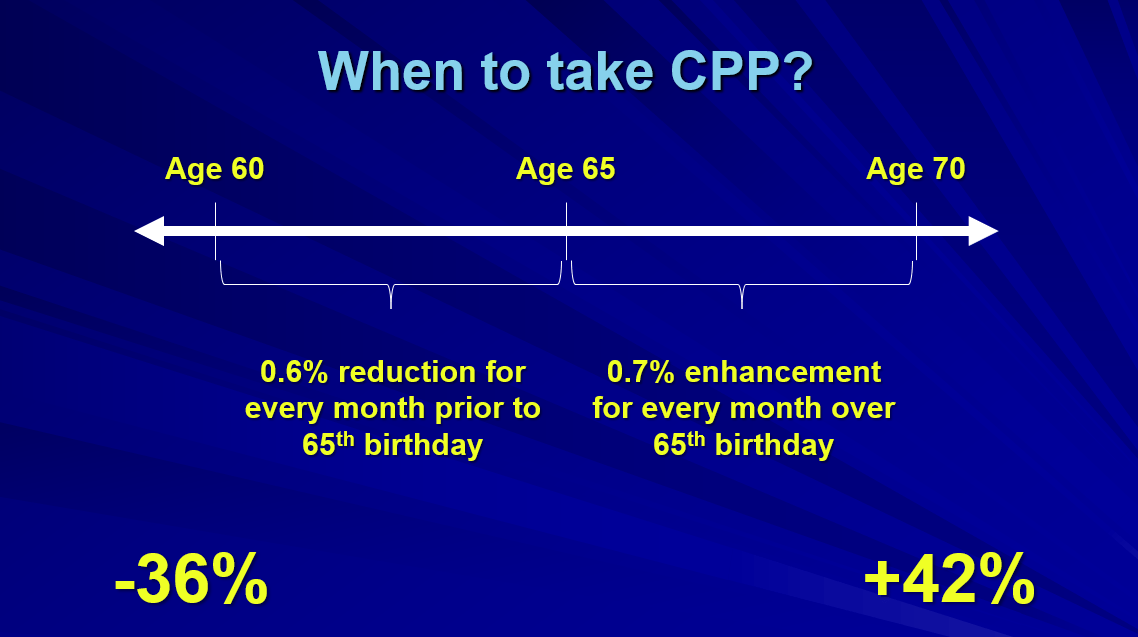

How To Apply For Your Cpp Canada Pension Plan Early And Should You

How To Apply For Your Cpp Canada Pension Plan Early And Should You

The Retirement Income Guide For Canadian Non Resident Expats Retire Happy

The Retirement Income Guide For Canadian Non Resident Expats Retire Happy

You And Your Pension Can You Take It Abroad Pwl Capital

You And Your Pension Can You Take It Abroad Pwl Capital

Retirement Planning For Immigrants T E Wealth

Retirement Planning For Immigrants T E Wealth

What Happens To Oas And Cpp Pension If You Retire Abroad

What Happens To Oas And Cpp Pension If You Retire Abroad

How International Social Security Agreements Affect Cpp And Oas Eligibility Retire Happy

How International Social Security Agreements Affect Cpp And Oas Eligibility Retire Happy

You And Your Pension Can You Take It Abroad Pwl Capital

You And Your Pension Can You Take It Abroad Pwl Capital

Https Www Cmg Ca En Wp Content Uploads 2016 02 Part 6 Finances B 1 Pdf

Https Catalogue Servicecanada Gc Ca Content Eforms En Callform Html Lang En Pdf Isp 5054a Fra Pdf