Can I Leave The Country If I Owe Taxes

Paying taxes when you live overseas is complicatedtheres no getting around that. Citizens who choose to retire abroad.

Owe Back Taxes You May Not Be Able To Leave The Country Or Return Causes

Owe Back Taxes You May Not Be Able To Leave The Country Or Return Causes

can i leave the country if i owe taxes

can i leave the country if i owe taxes is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i leave the country if i owe taxes content depends on the source site. We hope you do not use it for commercial purposes.

Yes if your tax debt is not considered seriously delinquent you can still travel outside the country if you have a valid passport.

Can i leave the country if i owe taxes. Those agreements you signed with your creditors still exist. The irs wants you to know. I worked for my university in this one year.

Keep in mind that if you currently have substantial outstanding tax debt it could just be a matter of time before you cross the threshold into seriously delinquent status. I left us in feb 2008 to go back to my home country i was a non resident in the us. I also did some work online that made me some good money.

Citizen what type of expat. Leaving the country doesnt end your obligation to repay your debts. White house lists ending covid 19 pandemic as trump accomplishment at best there seems a titular connection between this provision and highway safety.

You still owe the irs. In the usa they can revoke your passport if you owe the government 50000 or more. Can you leave the country if you owe back taxes.

As a result youd have a harder time securing new domestic accounts or maintaining the credit level of existing ones. More than six million russians could be deterred from their vacation plans this summer as they may be restrained for having unpaid private debt. Since i left the us in feb 2008 i didnt file my taxes.

Regardless of where you choose to live you can expect to pay any required taxes and penalties on your ira. Anyone who owes more than 10000 rubles about 160 euros and has a backlog of unpaid bank loans alimony taxes or. But the law has since changed and the irs can use its authority to prevent americans from obtaining passports and ultimately leaving the country if they fail to pay their taxes.

Specific rules apply depending on whether you remain a us. If you owe it more than 51000 in back taxes penalties and interest then under most circumstances it can and will instruct the state department to not issue you or. Nevertheless the law would authorize the.

However you can save yourself the headache of last minute complications by preparing for common tax situations well before april. I stayed there basically from december 2006 to feb 2008. Creditors can still report your account as delinquent even if they cant effectively collect the money after you move outside of us.

I was a student in the us for about an year. Here are two tax law situations that often apply to us. Even if you stay out of the country the irs arms are quite long.

Nothing magically happens when you travel outside of the us that absolves the debt. Russia seems to be adopting a similar tactic.

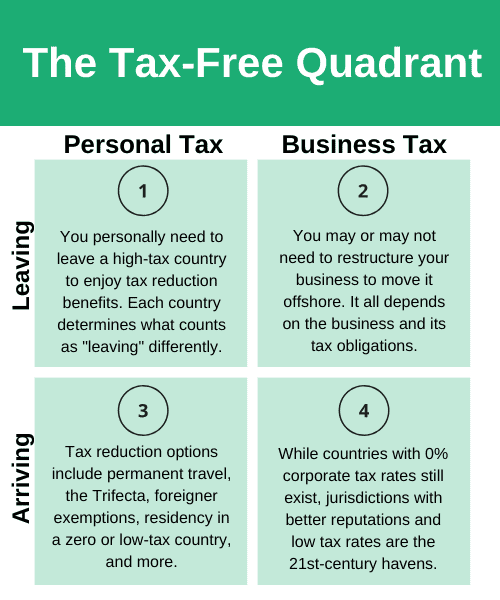

How To Legally Lower Your Taxes Nomad Capitalist

How To Legally Lower Your Taxes Nomad Capitalist

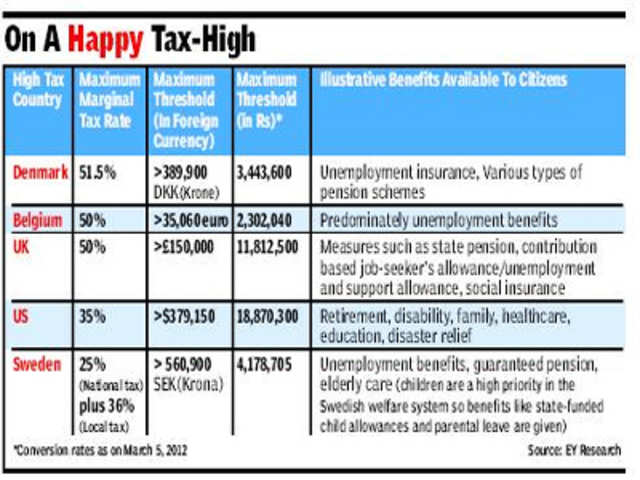

Can Income Tax Be Abolished What Are The Pros And Cons Of Abolishing Income Tax The Economic Times

Can Income Tax Be Abolished What Are The Pros And Cons Of Abolishing Income Tax The Economic Times

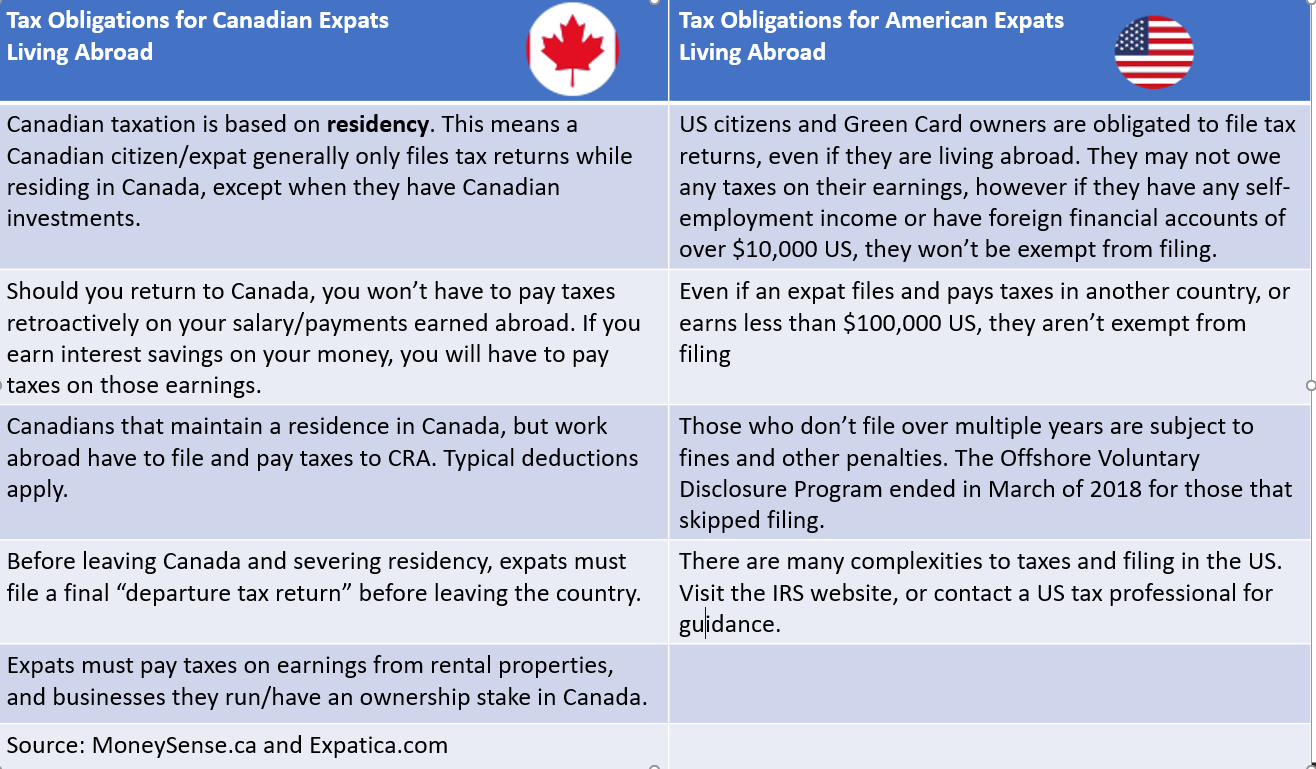

Taxes For Expats From North America Considerations For Canadians And Americans Working Abroad Xe Blog

Taxes For Expats From North America Considerations For Canadians And Americans Working Abroad Xe Blog

Deep In Debt To The Irs You May Not Be Able To Leave The Country Until You Pay Up The Morning Call

Debts In Other Countries And Going Bankrupt From Abroad Buddy Loans Blog

Debts In Other Countries And Going Bankrupt From Abroad Buddy Loans Blog

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png) Tax Avoidance And Tax Evasion What Is The Difference

Tax Avoidance And Tax Evasion What Is The Difference

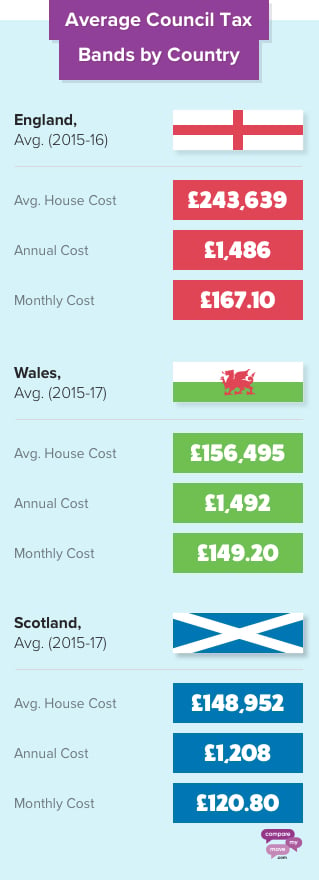

Would You Ever Leave Your Home Country To Lower Your Taxes Income Tax Federal Income Tax Tax Help

Would You Ever Leave Your Home Country To Lower Your Taxes Income Tax Federal Income Tax Tax Help

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

Taxes For Expats How To Lower Your Liability Working Overseas

Taxes For Expats How To Lower Your Liability Working Overseas

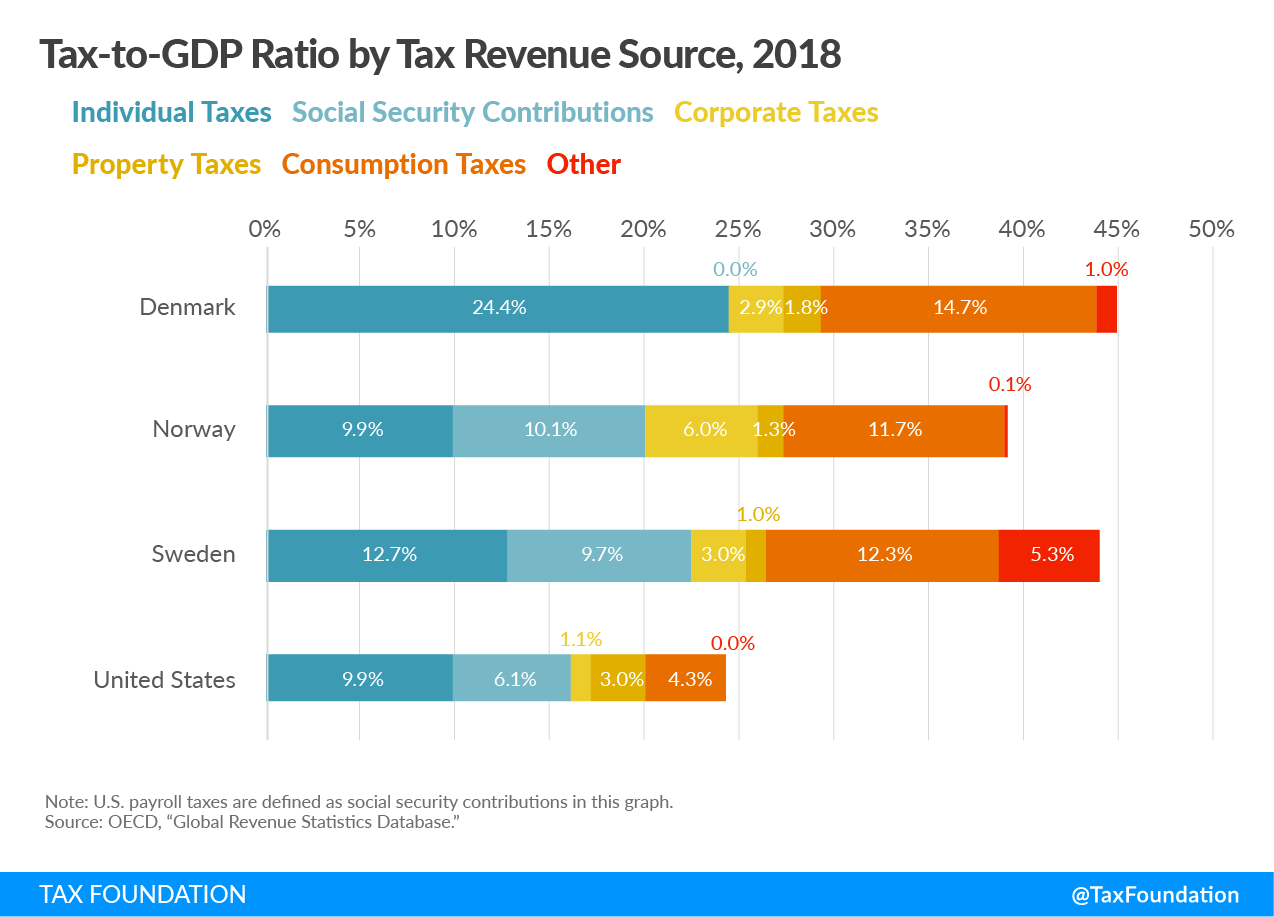

How Scandinavian Countries Pay For Their Government Spending

How Scandinavian Countries Pay For Their Government Spending