A Tax On Products Being Brought Into The Country

It became part of hmrc in 2005 but people still use the old name in unofficial contexts. A tax on products being brought into a nation is normally called a tariff.

The Basics Of Tariffs And Trade Barriers

a tax on products being brought into the country

a tax on products being brought into the country is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in a tax on products being brought into the country content depends on the source site. We hope you do not use it for commercial purposes.

Taxation means that another party has to pay the tax.

A tax on products being brought into the country. Taxation means that another party has to pay the tax. 2020 08 13 025828 2020 08 13 025828. However you may be required to furnish proof that you paid any estate or gift tax to a foreign government.

The action of a state setting aside a national law it considers unconstitutional 3. Low income tax jurisdictions normally supplement lost government revenues with taxes on most goods imported into the country known as customs and import duties. A reduction in the amount of jobs money and goods 4.

While you may not need to pay tax on large sums of money being sent abroad some governments will require you to file a declaration that you are bringing the money into the country. Tariffs can be positive or have negative results. One who comes into a country of which he or she is not a native 5.

Taxation means that another party has to pay the tax. Support for one section without regard for the needs of the other sections or the nation as a whole tariff 6. A tax on products being brought into a nation is normally called a tariff.

A tax on products being brought into a nation is normally called a tariff. Tariffs can be positive or have negative results. The former name for the british government department responsible for collecting taxes on goods that are bought or sold or brought into the country.

The middle class in europe arose from traders and merchants who exploited the increased interest in goods and products from. 1 0. A tax on products thats being brought into the country.

A tax on products being brought into the country 2. Asked by theajaha hill 1 2 answer. Tariffs can be positive or have negative results.

Again contact a. Many but not all countries have double taxation treaties in place which protect citizens from paying tax on the money twice. Failing to declare the assets could result in a fine.

What is the name of the tax on goods brought into a country from.

The Basics Of Tariffs And Trade Barriers

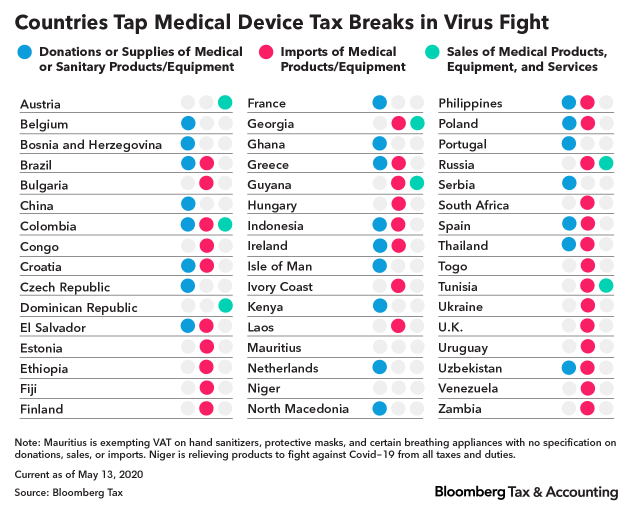

A Global Push For Pandemic Tax Relief On Medical Equipment

The Basics Of Tariffs And Trade Barriers

Carbon Tax Pros And Cons Economics Help

Tax Types Of Tax Direct Indirect Taxation In India

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Oracle E Business Tax Implementation Guide