Can You Claim Dependents That Live In Another Country

You cant claim any dependents if you or your spouse if filing jointly could be claimed as a dependent by another taxpayer. Can i claim my parents as dependents if they live in a foreign country.

Tax For Expats Claiming Dependents On Your Us Tax Return

Tax For Expats Claiming Dependents On Your Us Tax Return

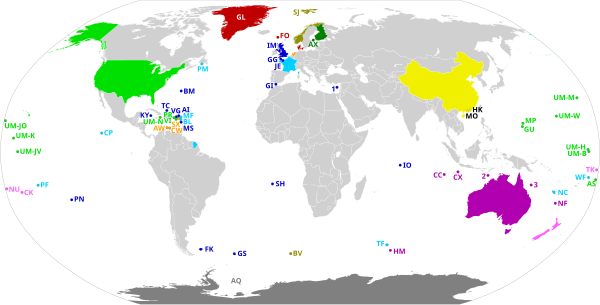

can you claim dependents that live in another country

can you claim dependents that live in another country is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you claim dependents that live in another country content depends on the source site. We hope you do not use it for commercial purposes.

You cant claim a married person who files a joint return as a dependent unless that joint return is filed only to claim a refund of withheld income tax or estimated tax paid.

Can you claim dependents that live in another country. If you were a us. The person doesnt have to live with you in order to qualify as your dependent on taxes. Citizen when your child was born the child may be a us.

For all other dependents the irs will disallow the exemption if they reside in any foreign country other than canada and mexico. Can i claim them as dependants on my federal income tax. Have been a citizen or resident of the united states or a resident of canada or mexico.

Your mother in law father in law brother in law sister in law son in law or daughter in law. If they are us citizens or us residents no it does not matter if they live in another country. Citizen resident alien or national and all other exemption requirements are met his foreign residency is irrelevant for the purpose of claiming him on your return.

Citizen even if the other parent was a nonresident alien and the child was born in a foreign country. They reside in the philippines. A person can still be an other dependent qualifying relative in irs parlance even though they do not have to actually be related if not a qualifying child if he meets the 6 tests for claiming a dependent.

As long as your dependent is a us. However the person must be a relative who meets one of the following relationship test requirements. I am the only supporter of my mother in law and brother in law who is a minor.

Can i claim a foriegn dependant in another country. And no i already know a dependent does not have to have ctizen status. Here are some of the basic rules to see if it applies.

Did not file a joint income tax return with anyone else. Can you give me a source that says a dependent needs to me residing in the us. But they must meet all the requirements as shown for you to be able to claim them as dependents.

Unfortunately you probably cannot claim them. According to the irs.

The Truth Behind Dependents And Exemptions

The Truth Behind Dependents And Exemptions

The Truth Behind Dependents And Exemptions

The Truth Behind Dependents And Exemptions

Indians Working Abroad Do Not Need To Pay Tax In India

Indians Working Abroad Do Not Need To Pay Tax In India

How To Obtain Permanent Residence In Italy

Completing Form 1040 With A Us Expat 1040 Example

Completing Form 1040 With A Us Expat 1040 Example

25 Things You Need To Know About Us Expat Taxes

25 Things You Need To Know About Us Expat Taxes

Want To Escape From America 12 Countries Where You Can Buy Citizenship And A Second Passport

Want To Escape From America 12 Countries Where You Can Buy Citizenship And A Second Passport

The 9 Easiest Countries To Get A Work Visa Live And Invest Overseas

The 9 Easiest Countries To Get A Work Visa Live And Invest Overseas

Countries Where You Can Buy Citizenship Residency Or Passport Business Insider